The Financial Markets Authority (FMA) has released a report into sales practices within the life insurance industry.

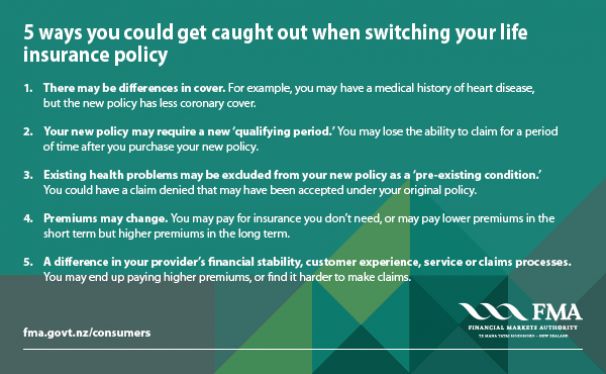

The report states that of the $1.7 billion New Zealanders spent on annual life insurance premiums in the year to 30 June 2014, a significant number of existing policyholders were switched between providers. This switching activity is called "replacement business".

The report says current remuneration structures used by the insurance providers present the risk of conflicts of interest that may harm consumers and could negatively affect the overall price, and therefore accessibility of life insurance to New Zealanders.

The FMA says New Zealand has 8,200 registered financial advisers and authorised financial advisers, of whom 3,700 sold at least one life insurance policy that was active in 2014.

Of the 1,100 advisers who had more than 100 active life policies on their books, 200 met the FMA's criteria for a high estimated rate of replacement business.

The FMA says in June 2014 those 200 advisers had 65,000 active policies between them, involving about $110 million in annual premiums.

It says it will be taking a closer look at the conduct of those advisers with the highest volumes of replacement business.

"We will be examining the basis on which policies have been switched or replaced and the drivers for that activity - with a particular reference to incentives (of whatever form) provided by insurance providers," FMA Director of Regulation Liam Mason says.