A whole new way of estate gifting taking off in NZ

September is Wills month, and Eleanor Cater from Community Foundations looks at endowment funds, an option for clients to make big, strategic gifts for charitable benefit.

We are all familiar with charity giving, whether it be a few coins in a bucket at the train station, regular giving through appeals or leaving a bequest to a favourite charity in a will.

What’s not so understood is the idea of endowment fund giving; an option for clients to make big, strategic gifts for charitable benefit which can be invested in perpetuity, without the need to establish their own charitable trust.

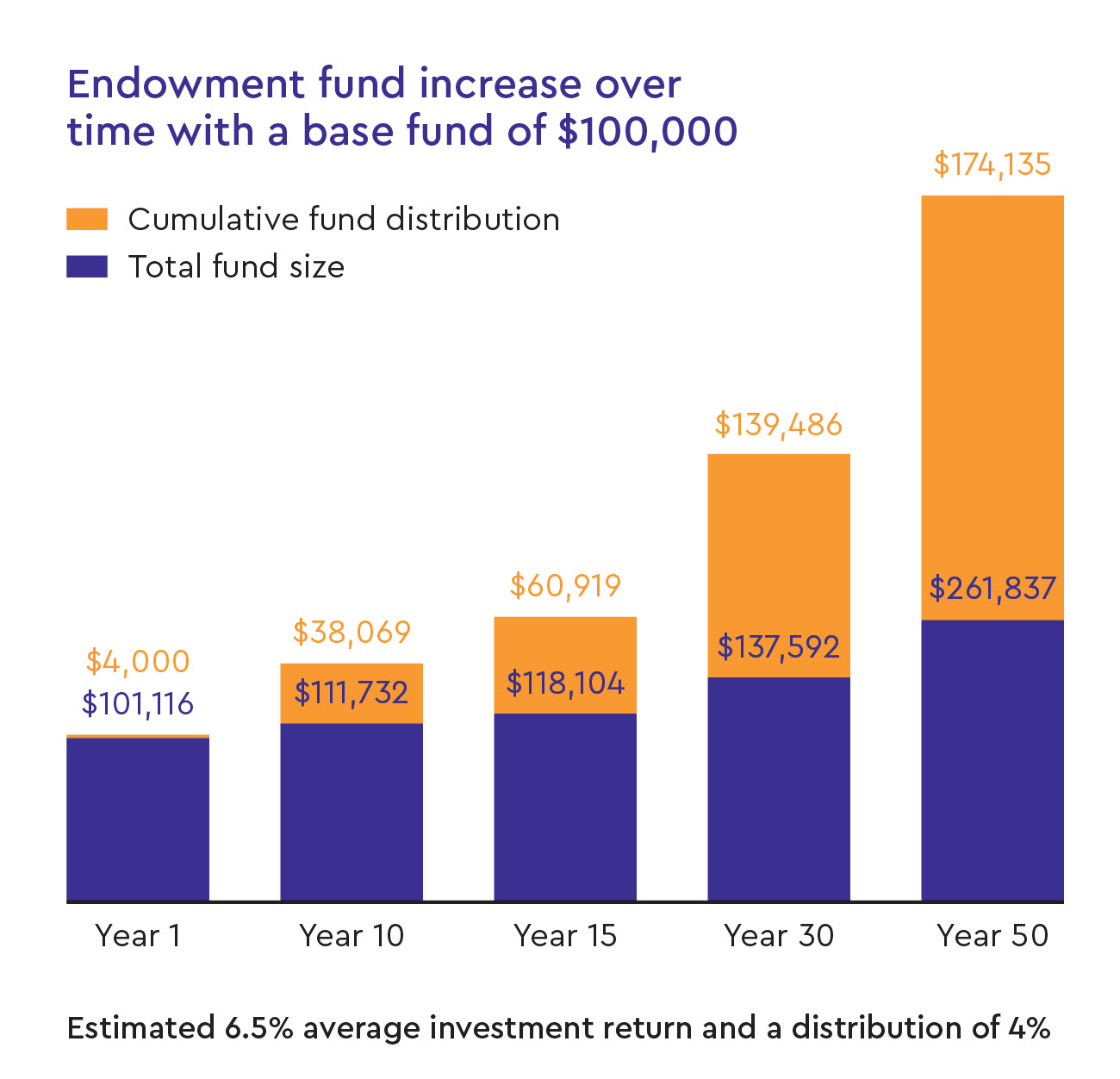

An endowment fund is established when a donation is invested in perpetuity, with the income from the investment returned to benefit charitable purposes, providing a reliable, ongoing income stream.

With 4% as a guide for distribution, $1m invested in a not-for-profit structured endowment fund can return an estimated $40k, each and every year, to a nominated charity, forever.

There are many people who prefer an independent structure and the strategic nature of long-term structured philanthropy over direct charitable giving (or a combination of both). Earlier this year, the US National Philanthropic Trust (NPT) published its 2020 Donor-Advised Fund Report and the findings confirmed sharp growth in endowment and ‘donor-advised’ funds (DAF).

While the idea of DAF or endowment funds is a relatively new giving concept in New Zealand, our experience shows interest in this form of giving is growing faster than ever before.

Community Foundations (17 across NZ) pool individual endowment funds in communities. They saw their funds grow 33% in the past financial year alone, exhibiting growth being experienced worldwide of what is being labelled ‘the fastest growing form of philanthropy in the world today’.

The research across the world is consistent: in the USA, UK and Australia research has shown that the single most significant factor which has helped to increase the incidence of charitable gifts in wills is the mention of charitable giving by a lawyer at the time a will is being prepared

Most people tend to put off estate planning in normal times. However, from a massive longitudinal study in the U.S. we also know when those plans are made and changed.

The typical triggers for planning fall into one of two camps, family structure changes or “death becomes real” events.

Family structure changes include marriage, divorce, birth of first child, birth of a first grandchild, and widowhood. “Death becomes real” includes diagnosis of illness, moving to aged care, or approaching death.

Right now, many people are living the “death becomes real” experience through a global pandemic. Consequently, across the world there has been a major upsurge in will-making, particularly online.

Towards the end of 2020 More Strategic carried out a study which showed that 16% of New Zealanders contacted their solicitor to revise their will during the pandemic, whilst a further 54% considered it (but haven’t done it yet).

From the same study, 21% of respondents showed intent to leave a gift in their will to charity, and a further 22% thought ‘maybe they would’.

We know from research that the charitable component of an estate plan is, for many people, highly fluid.

In one experiment with British lawyers simply asking the question, “Would you like to leave a gift in your will to charity?” this more than doubled the number of people including charitable bequests in their wills.

Even small alterations in the wording used to describe such gifts results in dramatic changes in both charitable intentions and actual will contents. For example, social framing was also shown to be a powerful motivator – almost three times as many people will leave a charitable bequest if their lawyer suggests that it is something other people do.

And the research across the world is consistent: in the USA, UK and Australia research has shown that the single most significant factor that has helped to increase the incidence of charitable gifts in wills is the mention of charitable giving by a lawyer at the time a will is being prepared.