New Zealand Law Society - Open and Transparent Billing

Charging certain fees or disbursements when billing may be unlawful or misleading. Therefore, it is important to be up front with how you are billing and what you are billing for. Below are the Law Society’s principles for open and transparent billing with respect to disclosure and disbursements.

The Lawyers and Conveyancers Act (Lawyers: Conduct and Client Care) Rules 2008 state that ‘a lawyer must not charge a client more than a fee that is fair and reasonable for the services provided, having regard to the interests of both client and lawyer.’

Lawyers need to be aware that some fees or disbursements may not be able to be claimed or charged for because they are excessive or misleading. Examples of potentially misleading practices include:

Charging inappropriately can breach elements of the Lawyers and Conveyancers Act (Lawyers: Conduct and Client Care) Rules 2008. These elements might include:

For example, Canterbury Westland Standards Committee v P Currie [2015] NZLCDT 15 emphasises the necessity to be open and transparent when billing. In this case, the lawyer admitted a charge of unsatisfactory conduct and was censured, ordered to refund the fees, apologise to the clients, undertake practical training or education and pay costs. Paragraphs 3 to 5 are worthy of study:

The charges arise from the practice adopted by the respondent whereby he charged office expenses as a set percentage of the fee value. He was as well adding an uplift to LINZ disbursements by a method that did not disclose to the clients the fact or extent of the uplift that was being added. He did not set out in his invoices as a separate item the “agency” portion of the charge.

The respondent admitted that he had continued a practice that had been in place when he was an employee of two major Christchurch law firms prior to commencing practise on his own account as a sole practitioner. The method had been disapproved of by the New Zealand Law Society (“NZLS”) for some years. Material had been published to educate practitioners about it. The respondent had failed to heed the advice from the Property Law Section of NZLS and continued to use the outdated system.

The respondent immediately ceased the practice once he had been confronted about it. He has readily admitted the charge of unsatisfactory conduct.

The Tribunal commented that the sums involved justified the committee referring the charges to the Tribunal.

In LCRO 176/2022 SP v AQ (15 August 2023), the LCRO considered the dictionary definitions of the words ‘expense’ and ‘disbursement’. The LCRO found at paragraphs 60 to61 that:

An ‘expense’ is defined by the English Oxford Dictionary as “the charges, costs, items of outlay, incurred by a person in the execution of any commission or duty; ‘money out of pocket’”.

A ‘disbursement’ is defined as being the action of disbursing, which, in turn is defined as being “to pay out or defray (costs, expenses)”.

In each case, the term relates to costs required to be paid to a third party in the course of completing a client’s instructions.

At 63 and 64 the LCRO was more specific;

Paragraph 6 of Ms SP’s terms and conditions, includes items such as ‘file opening fees’, ‘AML client due diligence checks’, ‘preparing undertakings’, ‘solicitor’s certificates’, and the like. These are not expenses, or disbursements as commonly understood, and defined.

All of the items listed as an ‘expense’ in Ms SP’s invoice, other than the title search fee, are not payments that have been made to a third party. They are matters which would have been undertaken by Ms SP or her staff, to be taken into account when fixing the fee to be charged.

A disbursement is a payment to a third party, billed to the client as charged to the law practice. An identifiable disbursement should be included only if it is reasonably and properly incurred or expected in relation to the transaction.

Any items that are not paid to a third party, for example an office service fee or overhead recovery, should be separately disclosed in the terms of engagement and positioned in the invoice under a "sundry fees" heading. Included in this category may be items such as internal photocopying, tolls, faxes etc not readily identifiable as an external payment.

Additionally, including as an expense recovery a proportion of an external fee payable by the law practice such as an insurance premium or a Landonline licence fee is not permitted as it is not specific to the client or a true disbursement and would be expected to form part of a lawyer's hourly rate. Any such additional fee should at the very least be fully disclosed in the terms of engagement.

If the AML/CFT on-boarding process is to commence before terms of engagement are provided and there is an intention to charge the client for that process, then the charges should be disclosed to the client as early as possible.

This 2023 decision by the LCRO stands in stark contrast to the traditional practice of a number of firms to charge overhead recoveries as expenses. Those firms should change their positioning of those charges on their invoices.

In the now rare instances where a firm operates a separate agency firm that is related to the law firm, this must be disclosed in the client care information provided prior to undertaking work. A copy of the invoice rendered by the related entity should be attached to the bill of costs shown as a disbursement including a breakdown of the agency/disbursement components. If the agency firm is not related to the law firm the same practice should apply.

The New Zealand Law Society Property Law Section Guidelines include guidance for disclosure in a closing statement, particularly with relation to charging fees relative to the operation of a trust account.

For every transaction where funds have passed through your law practice's trust account, you must provide the client with a complete and understandable statement of all trust money handled for the client, all transactions in the client’s account and the balance of the client’s account (if any). This statement should accompany your report to the client.

If your firm's billing does not accord with the above principles, you should consider rectifying this.

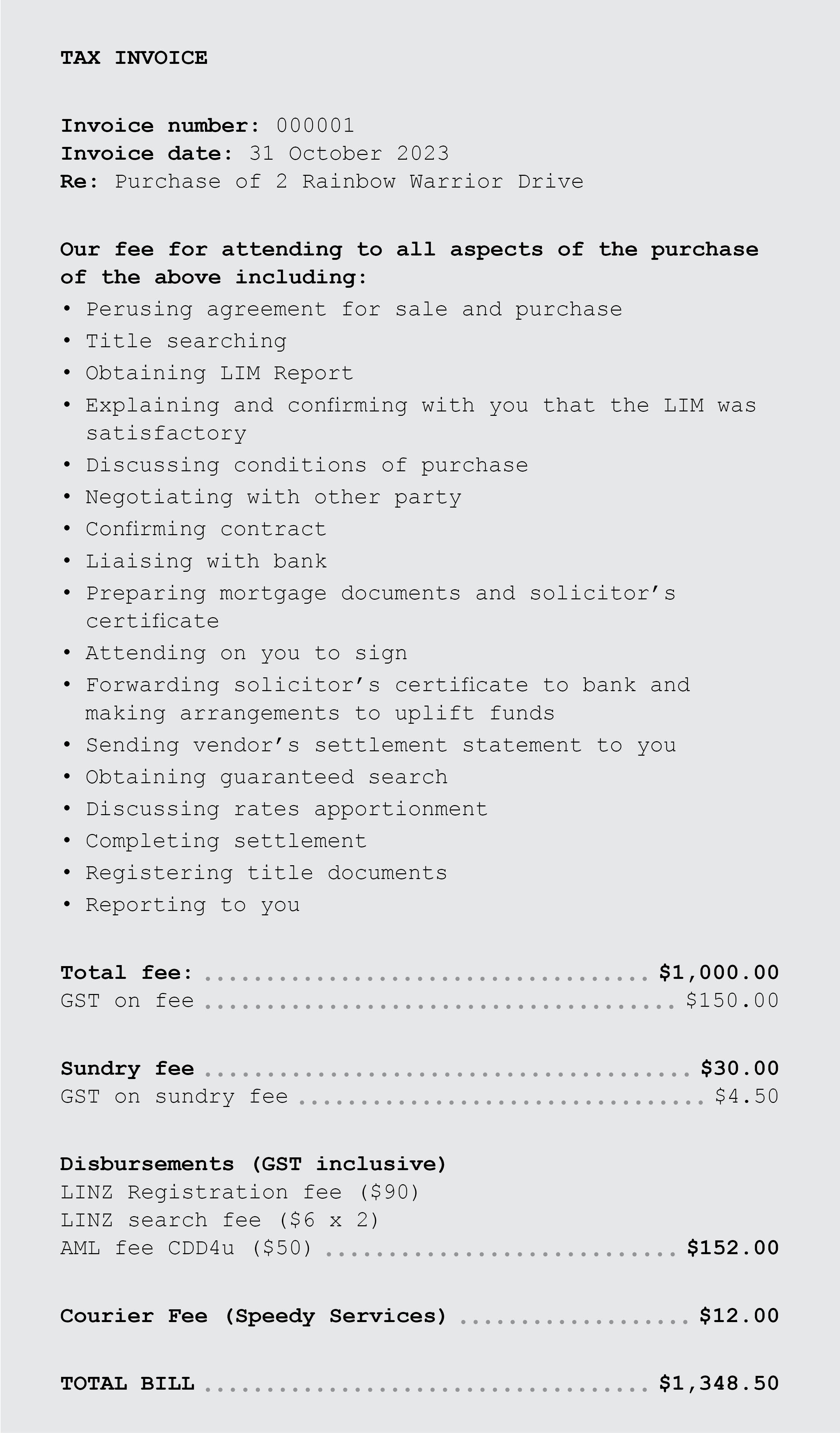

An example of a suggested bill of costs: